Where to Play and How to Win

- 08.04.2023

- Posted by: Tom Tischner

- Category: Innovation

Previously, we posted two articles on fundamental metrics that are required for an accurate pipeline forecast: Velocity, the speed with which opportunities go from definition to booking, and Yield, a measure of the effective win rate in your funnel.

Funnels are like combustion engines; no matter how you design them, there are losses. In the ideal case, 100% of the fuel supplied to an engine is converted to kinetic energy. But we all know combustion engines have massive frictional losses that translate into heat.

And so it is with funnels. No matter how well you implement your Sales process in #CRM , and no matter how good a Sales team you have, getting 100% of the rubber on the road is impossible.

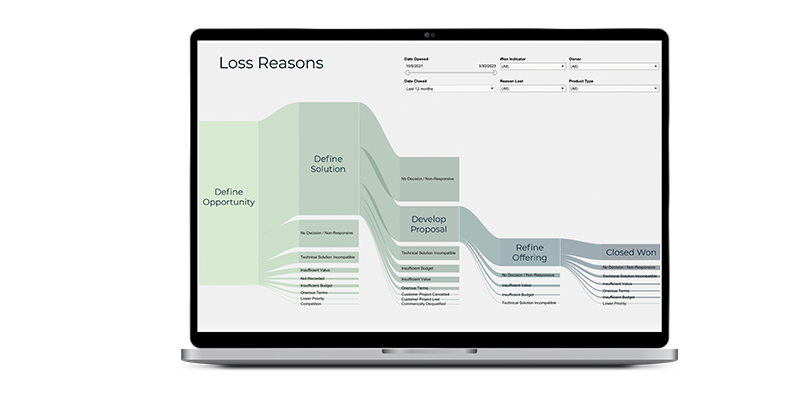

The difference between truly lost energy in an engine and the losses in your #funnel, however, is that a lot of insights can come from understanding when and why you lose opportunities. This is where you construct a loss analyzer. Looking at the example below, you can utilize a #Sankey chart to quickly understand your losses by CRM stage.

The vertical columns correspond to the Sales stage within your opportunity progression, the actual Sales process. What you want to see is that most of the losses occur early in the process, as is the case here: The majority of losses were categorized as “No decision/Non-responsive” during the opportunity definition stage. It’s much better to lose prospects that aren’t serious or cannot attend to buying the goods or services you offer. But we’re also seeing some of those same losses at the last stage, when the likelihood of winning is arguably high. Why would you send a proposal to a non-responsive customer?

So now what? How do you use these loss reasons? Most funnels we see have inconsistent or missing loss reason entries; so the first job is to come up with the 6 or 7 reasons that sufficiently characterize the loss.

By far the most interesting loss reason Sales teams use is price. The argument is that the prospect decided to go with a cheaper or less expensive solution. Ok, but what’s the action? Lower your price to give up margin? Make it up in volume? Tell your manufacturing team to cut down costs? Not completely unreasonable, but for manufacturers of complex goods a more appropriate loss reason is “insufficient value.” The onus is on Sales to identify early in the Sales process what the prospect is going to do if they don’t buy from them. Are you solving the customer’s problem at a price that the problem is worth solving? Is there an ROI? What’s the competitive situation? Consistent feedback that the product or service has an insufficient value proposition leads to a strategic decision: Does the product need to be changed, deleted from the portfolio, or bundled with a service? Is a partnership or acquisition needed to target entry level customers? Is a CAPEX to OPEX model appropriate by offering a pay-as-you-go or service product?

We typically identify a half dozen loss reasons that give rise to important #strategic insights like the above example. Incompatible technical solution may suggest calibrating on a different target market; large losses due to lower priority may indicate a nascent market not sufficiently financed or may require helping customers better formulate their problem statements. Commercial disqualification and onerous terms may imply a shift in Sales activity toward account management where terms can be negotiated at a higher level etc.

Regardless of the situation, analyzing loss reasons is the important practice of understanding when and how things don’t go according to plan. They point to important gaps in the offering, lead to a better positioning in the market, and can help segment customers with different problem #statements that require tailoring of products.

Seldomly do we see good discipline around loss reasons where they are captured. Yet they’re key to improving win rates, to removing stale opportunities, and to drive shorter Sales cycle times. If you’re curious, take a look at our articles on Velocity, Win Rates, and Staleness, and ask yourself how those metrics play out in your Sales funnel.

We’re always inspired by your thoughts and suggestions, so please keep them coming!